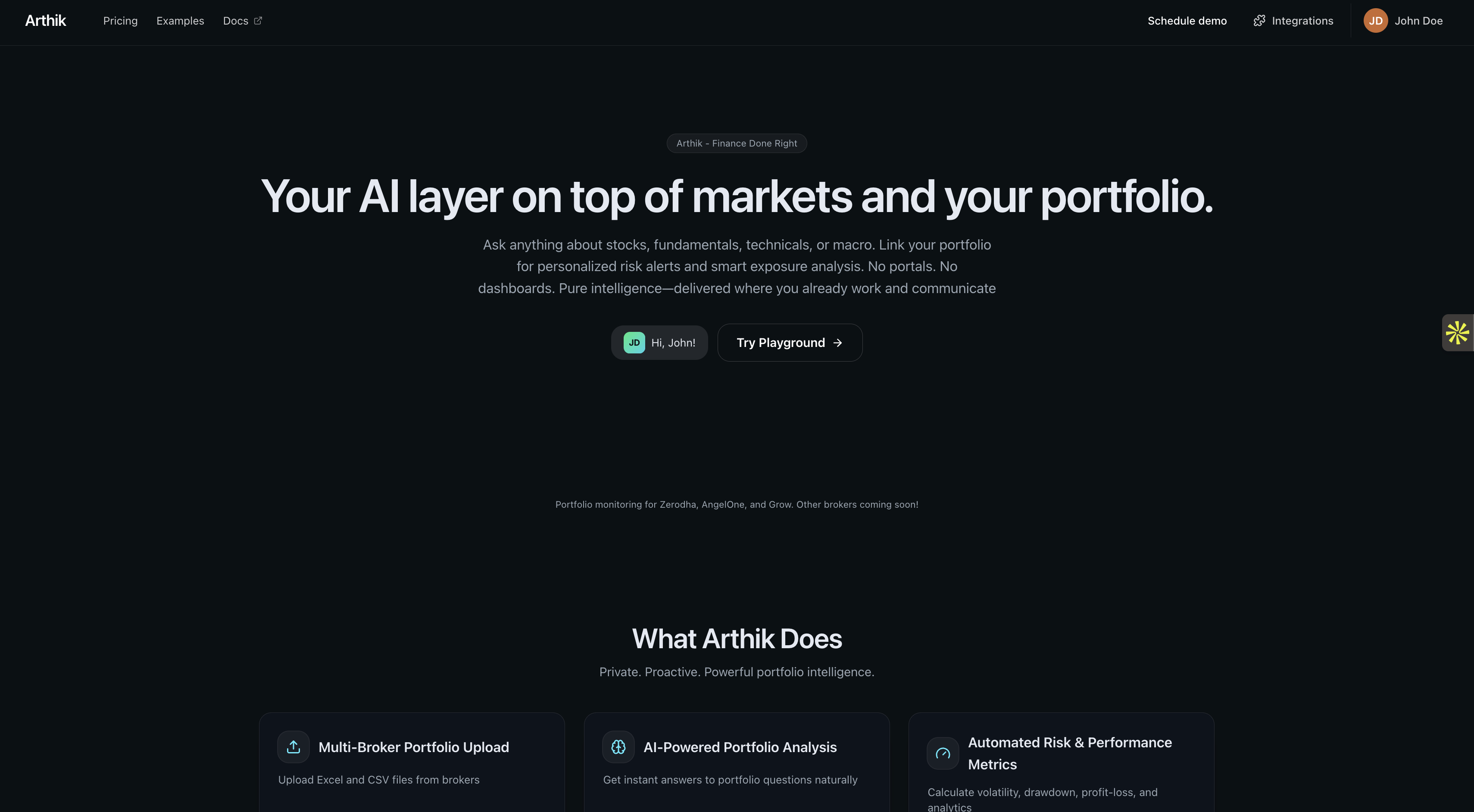

Arthik

An AI-powered portfolio intelligence platform that provides personalized risk alerts, smart exposure analysis, and natural language queries for portfolio management. Supports multi-broker portfolio uploads and real-time financial data integration.

🔗Website | Demo Video

Technologies Used: Langgraph, FastAPI, GCP Cloud Run, Langsmith (LLM Eval)

Overview

Arthik is an AI agent platform for finance that acts as an intelligent layer on top of markets and portfolios. It enables users to ask questions about stocks, fundamentals, technicals, or macroeconomics in natural language, and provides personalized portfolio insights without requiring portals or dashboards.

Features

-

Multi-Broker Portfolio Upload: Upload Excel and CSV files from multiple brokers including Zerodha, AngelOne, and Grow. Other brokers coming soon!

-

AI-Powered Portfolio Analysis: Get instant answers to portfolio questions naturally. Ask anything about your holdings, performance, or risk metrics in plain English.

-

Automated Risk & Performance Metrics: Calculate volatility, drawdown, profit-loss, and comprehensive analytics automatically.

-

Real-Time Financial Data Integration: Access live prices, financial statements, earnings data, and market information.

-

Market News & Research: Search NSE, BSE, SEBI circulars and news to stay informed about market developments.

-

Custom Financial Calculations: Generate custom calculations for any portfolio question on-demand.

How It Works

- Connect Broker: Upload your portfolio holdings in xlsx or csv format from your broker.

- Ask Queries: Interact with Arthik AI in natural language (e.g., “give me top 5 performing stocks in my portfolio”).

- Make Better Decisions: Act on insights delivered directly to you.

Key Capabilities

- Natural Language Interface: Ask portfolio questions in human language and get instant, intelligent responses.

- Private & Secure: Bank-level encryption ensures your financial data stays private and is never shared with third parties.

- Proactive Intelligence: Automated risk alerts and smart exposure analysis help you stay ahead of portfolio changes.

- No Dashboards Required: Pure intelligence delivered where you already work and communicate.

Use Cases

- Multi-broker investors who want unified portfolio analysis

- Fund managers needing quick portfolio insights and risk metrics

- Long-term investors seeking natural language portfolio queries

- Traders requiring real-time financial data and market news

Motivation

Arthik was built to democratize portfolio intelligence by removing the complexity of traditional financial dashboards. Instead of navigating multiple portals and manually calculating metrics, users can simply ask questions and get intelligent, personalized answers about their investments.